In the first five months of 2025, insurers issued over 1.6 million short -term compulsory civil liability insurance policies. This is 45 percent more than for the entire period from the moment of launch of the service last year. Analysts associate the popularity of the product with its flexibility and recent modifications on behalf of the Bank of Russia.

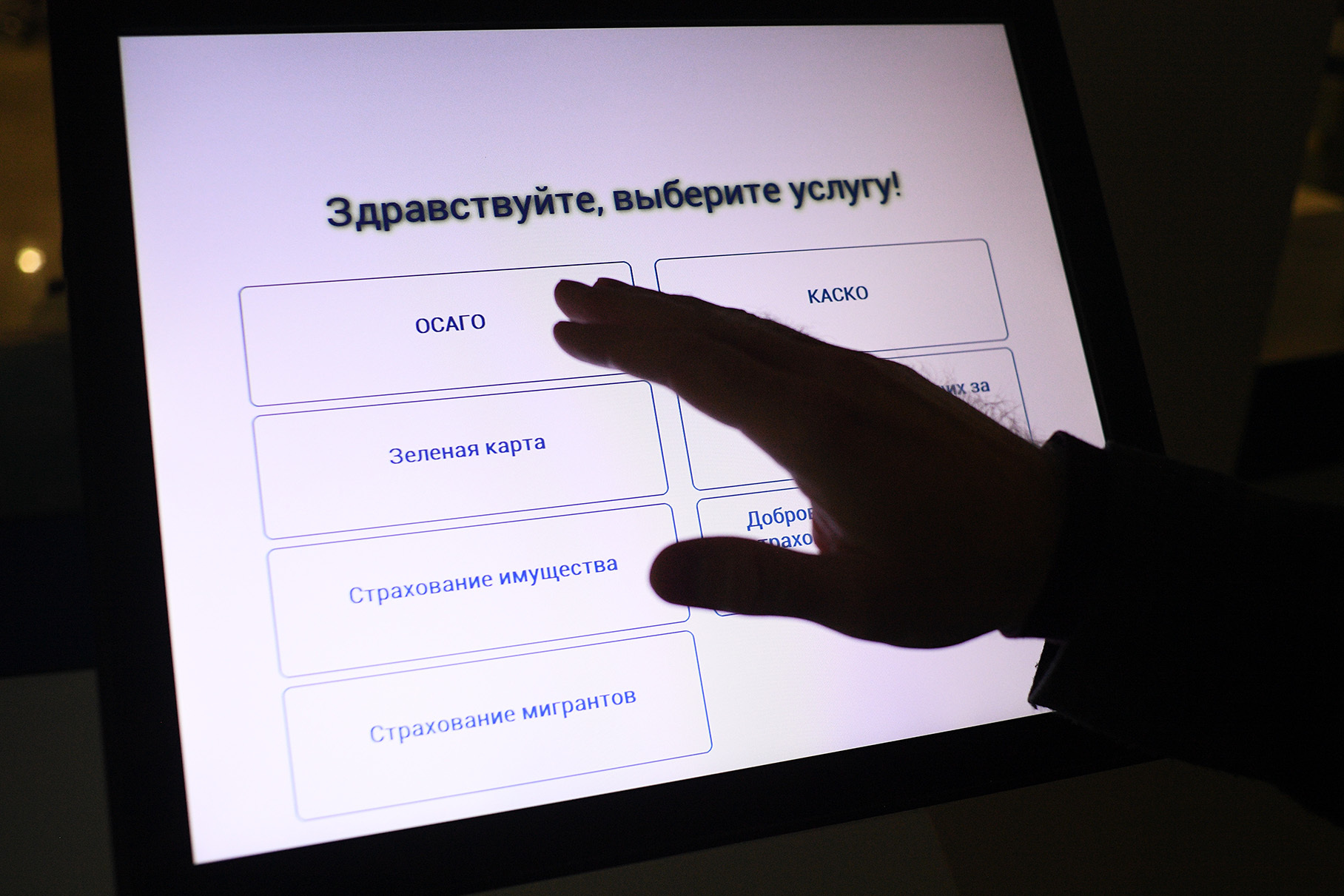

From January to May 2025, the insurance companies in Russia issued more than 1.6 million short -term OSAGO policies. Such data were presented by the National Insurance Information System with reference to the information of the automated insurance information system. Compared to the period from March to December 2024, the volume of short -term insurance issued by 45 percent. This indicates the growing interest of motorists in new insurance tools.

Drivers can make it possible to receive an additional payment for OSAGO in Russia can four times increase payments for CTP for causing harm to life by Russians told how the one will work with Belarus OSAGO will work

CTP short -term policies appeared in Russia on March 2, 2024 as an alternative to annual insurance. First, drivers could draw up a document for a period of one day to three months. In April 2025, on behalf of the Bank of Russia, the service was finalized: now the policy issued for one day has exactly 24 hours, and not up to 23 hours 59 minutes, as it was before.

Earlier, insurers reported the date of launch of the system of fines from the cameras for the absence of OSAGO. Automatic fixation of violations will begin on November 1, 2025 and will immediately act throughout the country without a transitional stage. The innovation was announced by the President of the Russian Union of Auto Stores, Yevgeny Ufimtsev. The same date was indicated in the order of the President of the Russian Federation Vladimir Putin.

The nightmare of insurance companies: the most expensive accidents