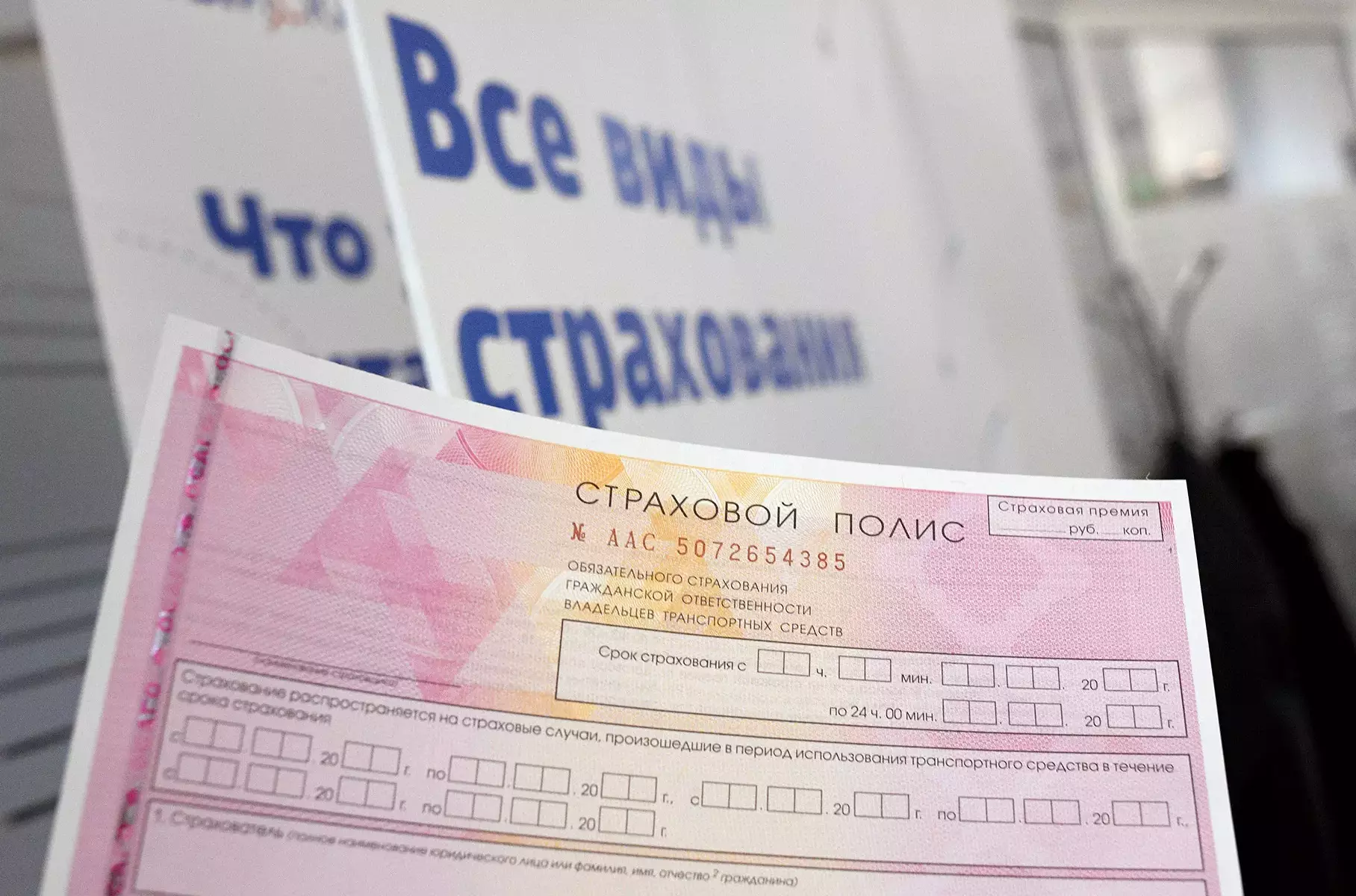

This was announced by the head of the Russian Union of Auto Stores, Evgeny Ufimtsev. Today, the maximum limit is half a million rubles. At the same time, public transport passengers are insured by two million rubles. Thus, for a similar injury, a passenger of a private car will receive four times less compensation than a citizen who has been traveling by bus or tram.

According to Ufimtsev, with an increase in payments for OSAGO for life and health to two million rubles, the cost of the policy will increase by 10-15 percent, or by about 1000 rubles. At the same time, there is a request from car owners to increase the repair limit – from the current 400 thousand rubles to a million. In this case, the “auto -citizen” may rise in price by 40 percent. As a result, the average compulsory insurance policy cost 7 thousand rubles will increase in price to 10 thousand.

In Russia, the rules for the operation of one -day CTP in Russia have changed a new way to design OSAGO to Russians told how the one will work with Belarus OSAGO will work

So far, the innovation is at the project stage, to evaluate the potential implementation of which the Bank of Russia should. Experts believe that by the end of this year changes in the CTP limits will not occur. However, already in 2026 in Russia they can increase maximum payments.

In September last year, the average payment for OSAGO has grown recordly in Russia. At the same time, the cost of compulsory insurance policies then decreased.

The nightmare of insurance companies: the most expensive accidents